MBA Acceptance Rates at the Top U.S. Programs and How the Data Should Inform Your Application Strategy

As an applicant or prospective applicant to top MBA programs, you might be wondering what your chances of acceptance are…and rightly so, applying to business school takes a ton of time and energy, you want to make sure all the effort pays off in the end! To simplify things, we’ve compiled a list of MBA acceptance rates at the top U.S. programs for the class of 2023. Analyzing this data reveals some interesting and sometimes surprising insights about selectivity across schools.

Stanford GSB is (Unsurprisingly) the Most Selective MBA Program

Many of you will not be surprised by the fact that Stanford GSB has the lowest acceptance rate of any U.S. MBA program. But just how selective it is might cause a few double takes.

The latest data shows that Stanford GSB accepts just 6% of those who apply! That’s right, of the 7,367 who submitted applications, only 445 were accepted. This was not an aberration – Stanford’s acceptance rate has hovered at 6-7% for at least the last five years.

For context, Harvard Business School’s acceptance rate was more than twice as high as Stanford’s at 12.5% – of the 9,773 people who applied, 1,222 were admitted. Purely from a numbers standpoint, if you are considering adding a dream program to your list, HBS is statistically easier to get into (not that we’re recommending you decide where to apply solely based on this fact).

The Most Selective Program After Harvard and Stanford Is…

If you said Wharton (you know, H/S/W as the saying goes), you would be WRONG! There are actually three programs that are slightly less competitive than Harvard and Stanford but more competitive than Wharton – Sloan, Columbia, and Haas. To be precise, Sloan had a slightly lower acceptance rate than even Harvard last year (!), but this was a bit of an outlier looking at historical data.

Why are Sloan, Columbia, and Haas so selective, you may wonder? There are a few factors at play. The most readily apparent is class size – Wharton enrolls a huge class each year (~900 students) and these other three programs are smaller (Haas’ class size is typically less than 300 students). There are simply fewer seats to fill, which is something to think about as you craft your list of target schools.

The second reason is a little more nuanced. Our experience is that these three programs, notably Sloan and Haas, have a heightened focus on fit with their unique cultures. All the top programs care about that nebulous concept, ‘fit’, but these two schools take it to the next level. If you are simply planning to blanket the top 5-10 U.S. programs with applications to see ‘what sticks’, it is likely you will strike out at Sloan and Haas unless you really take the time to know them and what they look for in applicants.

An ancillary factor driving Columbia and Sloan’s selectivity is the number of applications these programs receive (6,000-7,000, significantly more than other top 10 programs aside from H/S/W). With strong global brand recognition and, particularly for Columbia, a highly desirable location for both domestic and international applicants, they simply receive more applications. Sloan also continued to offer a GMAT waiver option after other programs pulled back from this COVID-related accommodation, which could have increased application volume.

Two of the Highest Ranked Programs Are Not as Selective as You May Think

A bright spot to note from the MBA acceptance rates data is that two of the highest ranked programs, Booth (#1 this year per U.S. News) and Kellogg (tied with Stanford for #3), have acceptance rates of 23% and 26%, respectively. Yes, the competition is still fierce, but those percentages are roughly 4x Stanford’s acceptance rate and double that of Harvard.

While there are multiple reasons for this, the math is simple. Kellogg and Booth have substantial class sizes (500-600 students) but do not attract the same number of applicants as their top five peers. It’s possible that people overlook Chicago in favor of the east and west coasts or are less familiar with the brand names of Kellogg’s and Booth’s parent universities. Whatever the driver, consider using this knowledge to your advantage when deciding where to apply.

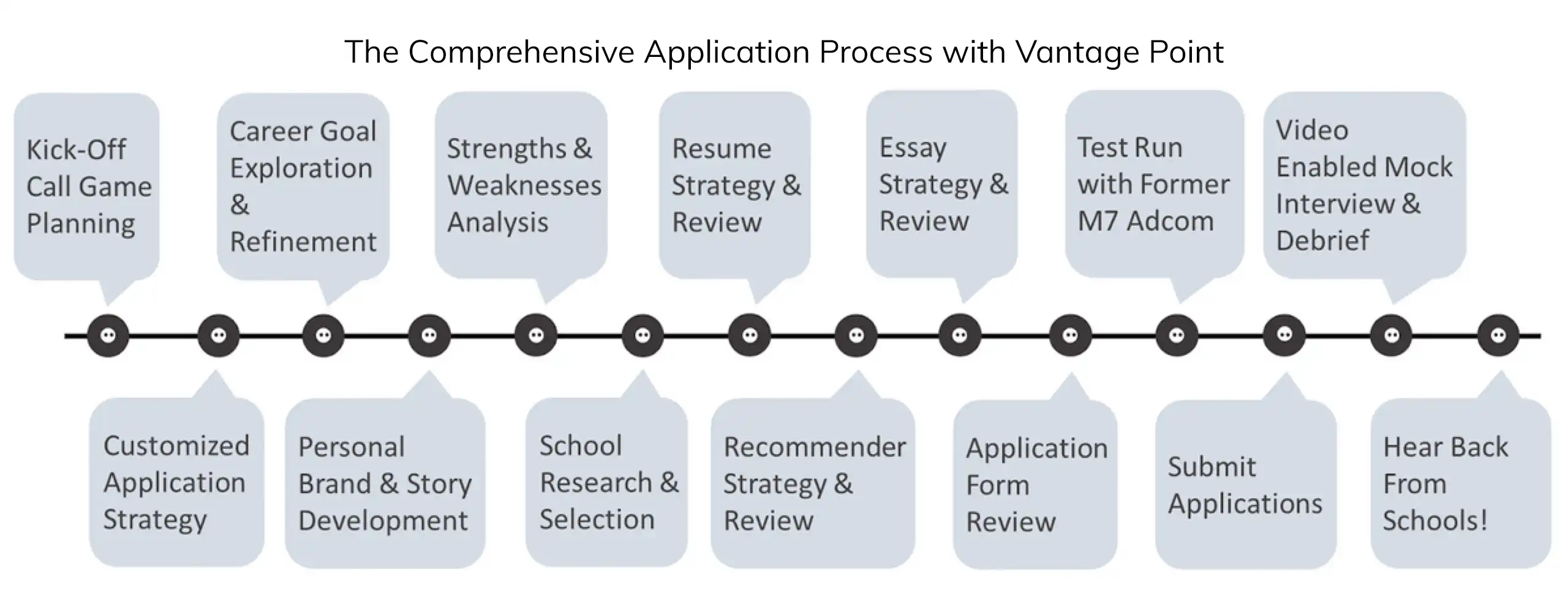

If you need help narrowing your search or an expert opinion on where you will be competitive, feel free to reach out for a free consultation.

MBA Acceptance Rates at the Top U.S. Programs for the Class of 2023:

| School | 2023 US News Ranking | 2022 US News Ranking | Applications Received | Acceptances | Enrolled | Acceptance Rate | Selectivity Index |

| Booth | 1 | 3 | 5,037 | 1,140 | 620 | 22.6% | 10 |

| Wharton | 2 | 2 | 7,338 | 1,338 | 897 | 18.2% | 6 |

| Kellogg | 3 | 4 | 4,632 | 1,205 | 508 | 26.0% | 13 |

| Stanford | 3 | 1 | 7,367 | 445 | 426 | 6.0% | 1 |

| Harvard | 5 | 5 | 9,773 | 1,222 | 1,010 | 12.5% | 3 |

| Sloan | 5 | 5 | 7,112 | 859 | 450 | 12.1% | 2 |

| Yale | 7 | 9 | 3,887 | 914 | 349 | 23.5% | 12 |

| Columbia | 8 | 7 | 6,033 | 948 | 614 | 15.7% | 4 |

| Haas | 8 | 7 | 3,841 | 677 | 291 | 17.6% | 5 |

| Ross | 10 | 13 | 4,003 | 808 | 398 | 20.2% | 9 |

| Tuck | 11 | 10 | 2,463 | 726 | 294 | 29.5% | 15 |

| Fuqua | 12 | 12 | 3,762 | 723 | 447 | 19.2% | 7 |

| Stern | 12 | 10 | 3,958 | 771 | 360 | 19.5% | 8 |

| Darden | 14 | 13 | 3,058 | 913 | 351 | 29.9% | 18 |

| Johnson | 15 | 15 | 2,105 | 620 | 304 | 29.5% | 14 |

| Tepper | 16 | 16 | 1,963 | 583 | 231 | 29.7% | 16 |

| Anderson | 17 | 18 | 3,085 | 919 | 372 | 29.8% | 17 |

| McCombs | 18 | 18 | 2,102 | 747 | 270 | 35.5% | 19 |

| Kenan-Flagler | 19 | 20 | 1,494 | 662 | 296 | 44.3% | 20 |

| Marshall | 19 | 16 | 2,418 | 555 | 218 | 23.0% | 11 |

Pingback: What are the most competitive MBA programs in the United States? - Agricultural Knowledge Network

July 2, 2024 7:09 pm